Managing Business Rate Records

To manage business rates:

Search for and open the relevant unit.

The unit must be have a Unit Type that is a hereditament (that is: the Unit Type in Units reference data has the Is Hereditament check box selected).

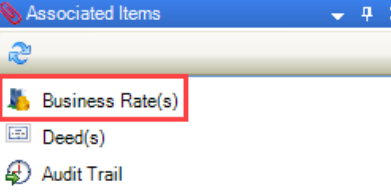

Click the Business Rate(s) option in the Associated Items panel.

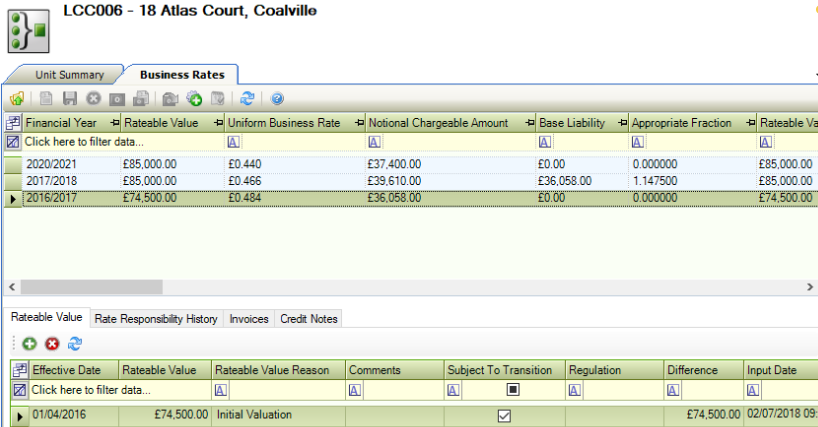

The Business Rates screen is displayed.

Enter details in the following sections as required:

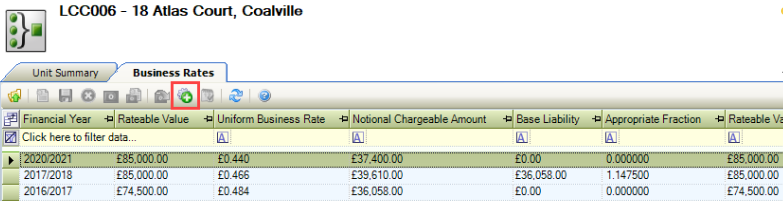

To add a business rate:

Click the New button.

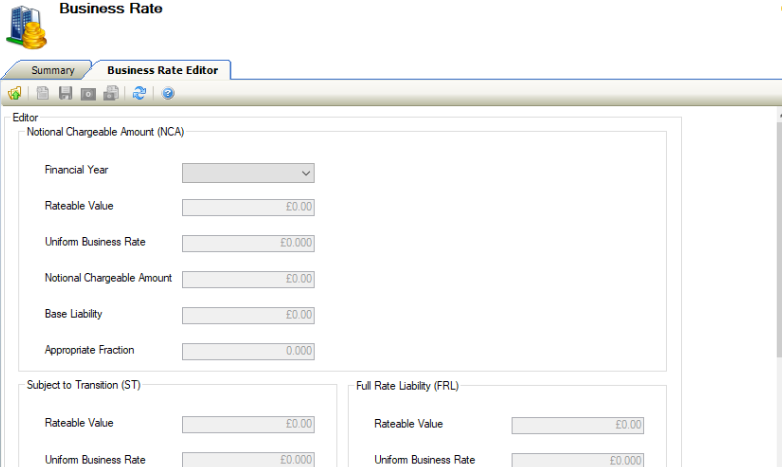

The Business Rate Editor is displayed.

The fields on the Business Rate Editor are described in the following table:

This field… | Holds this information... |

|---|---|

Financial Year | The financial year. |

Rateable Value | The Rateable Value (RV). |

Uniform Business Rate | The Uniform Business Rate (UBR) for the financial year. |

Notional Chargeable Amount | This is calculated from the current Rateable Value (RV) multiplied by Uniform Business Rate (UBR) for the year. If no Rateable Value has been added for the year, the next previous Rateable Value, based on the effective date, will be used in the calculation. |

Base Liability | The RV for the Business Rate from the last day of the previous financial year x UBR for the same financial year. If there is no RV in any of the previous years, or this is the first Business Rate Year, this value will be 0.00. |

Appropriate Fraction | This figure is calculated by first determining if the Business Rate is a small, medium or large increase or decrease. It will then be the factor (100 + or – the small/medium/large percentage) x the inflation rate / 100. The Business Rate is treated as small, medium or large based the value of the NCA against the Small and Medium Rateable Boundary. If it is less or the same as the small value, it is treated as small. If it is less or the same as medium, it is treated as medium. If it is greater than the medium value, it is treated as large. The Business Rate is treated as an increase if the NCA is greater than the Base Liability, and, decrease if the Base Liability is greater than the NCA. |

Rateable Value | The latest RV with the Subject to Transition check box selected. This is calculated if the Subject to Transition is selected against the Rateable Value. |

Uniform Business Rate | The Uniform Business Rate (UBR) for the financial year. |

Notional Chargeable Amount | This figure is calculated by multiplying the Rateable Value and Uniform Business Rate. |

Pro-Rata Supplement | This figure is calculated by multiplying the Supplement Rate (as defined in Business Rate reference data) by the RV. This is only calculated if the Rateable Value exceeds the Medium Rateable Value Boundary defined in reference data. |

Rateable Value | The latest RV with the Subject to Transition check box not selected. |

Uniform Business Rate | The Uniform Business Rate (UBR) for the financial year. This is calculated if the Subject to Transition is not selected against the Rateable Value. If there is no value without ST, then this will not be calculated. |

Notional Chargeable Amount | This figure is calculated by multiplying the Rateable Value and Uniform Business Rate. |

Pro-Rata Supplement | This figure is calculated by multiplying the Supplement Rate (as defined in Business Rate Year Reference Data) by the RV. This is only calculated if the Rateable Value exceeds the Medium Rateable Value Boundary defined in reference data. |

Total Notional Chargeable Amount | The total Notional Chargeable Amount. |

Total Supplement | The total supplement. |

Overridden Supplement | The amount to override the supplement, if the total supplement requires amending. |

Sub-Total | This figure is calculated by adding the Supplement or Overridden Supplement and the Total Notional Chargeable Amount. |

Transitional Limit | This figure is calculated by multiplying the Base Liability and the Appropriate Fraction. |

Subject to Transition | Whether the rate is subject to transition. |

Transitional Adjustment | This figure is calculated by subtracting the Subject to Transition Notional Chargeable Amount from the Transitional Limit. |

Total Annual Liability | This figure is calculated by adding the Sub-Total and the Transitional Adjustment. |

Pro-Rata Liability | This figure is calculated by multiplying the Total Annual Liability and total number of liable days (based on a vacant Rate Responsibility types), then divided by 365 or 366 (depending on the year). |

Relief | This figure is calculated by multiplying the Total Annual Liability against the number of Relief days divided by 365 or 366 depending on the days of the year. |

Discretionary Relief | The discretionary relief amount, if required. |

Discretionary Relief Reason | The reason for the discretionary relief. |

Rates to Pay | This is calculated subtracting the Relief and Discretionary Relief from the Pro-Rata Liability. |

Overridden Rates to Pay Reason | The reason that Rates to Pay was overridden, if applicable. |

Click Save.

To add or edit a rateable value:

Select the relevant business rate record in the grid.

Select the Rateable Values tab, if it is not already selected.

Click the Add button.

Alternatively, double-click an existing record to edit it.

The Edit Rateable Value window is displayed.

Enter or edit the relevant details.

The fields on the Edit Rateable Value window are described in the following table:

This field… | Holds this information... |

|---|---|

Effective Date | The effective from date. This must fall inside the selected financial year. |

Rateable Value | The rateable value. |

Reason | The reason for the rateable value. These can be defined in Rateable Value Reason Reference Data (accessed by navigating to Estates > Business Rate > Business Rate). |

Comments | Any comments on the rateable value. |

Subject to Transition | Whether the rate is subject to transition. |

Regulation Applies | Whether a regulation applies. |

Regulation | The applicable regulation. This is only enabled if the Regulation Applies check box is selected. |

Last Rateable Value | If there is already a Rateable Value for the selected year, then the Calculated Transaction Detail section calculates the difference. Note: The difference is only between the previous and the current one being input. |

Last Effective Date | |

Difference | |

Input Date | The date the record was created. |

Last Update User | The user that last edited the record. |

Last Update Date | The date that the record was last updated. |

Click OK.

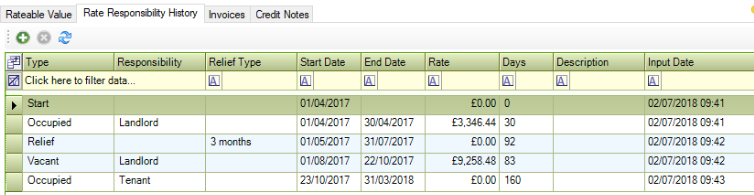

To add or edit rate responsibility:

Select the relevant business rate record in the grid.

Select the Rateable Responsibility History tab.

Click the Add button.

Alternatively, double-click an existing record to edit it.

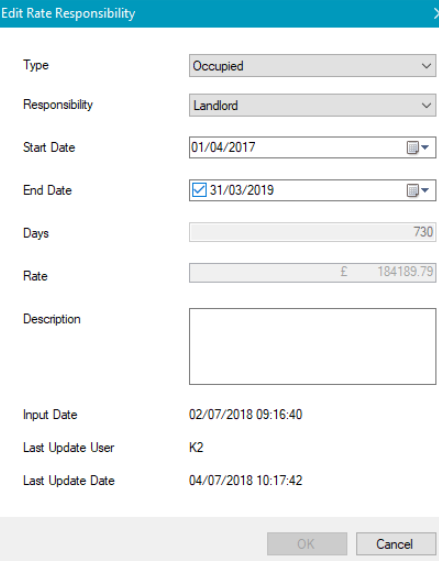

The Edit Rate Responsibility window is displayed.

Enter or edit the relevant details.

The fields on the Edit Rate Responsibility are described in the following table:

This field… | Holds this information... |

|---|---|

Type | The type of responsibility. |

Responsibility | The person responsible for the rate. These can be defined in Responsibility Reference Data (accessed by navigating to Estates > Business Rate > Business Rate). |

Start Date | The start date of the responsibility. |

End Date | The end date of the responsibility. |

Days | The number of days of responsibility. This is calculated automatically based on the Start Date and End Date fields. |

Rate | The rate. This is populated automatically and cannot be edited. |

Description | A description of the responsibility. |

Input Date | The date the record was created. |

Last Update User | The user that last edited the record. |

Last Update Date | The date that the record was last updated. |

Click OK.

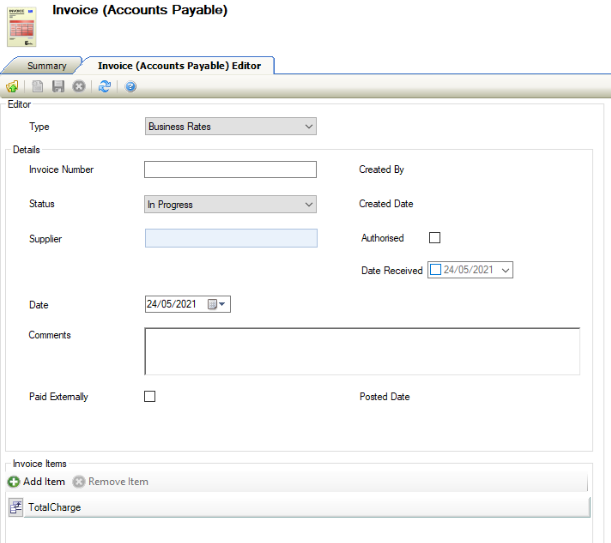

To add an invoice:

Select the relevant business rate record in the grid.

Select the Invoices tab.

Click the Add button.

The Invoice (Accounts Payable) Editor is displayed.

Enter or edit the relevant details.

Click Save.

Any Credit Notes that have been created for invoices linked to the Business Rates can be viewed by clicking the Credit Notes tab.