Managing Custodial Service Charges

Custodial Services are the duties performed to maintain the cleanliness of premises. Typical services include cleaning, waste disposal, recycling, pest control, carpet cleaning, window cleaning and replenishing sanitary products. The Running Cost functionality splits the total cost of custodial services per building across all department occupiers based on the space used.

The Department Space Management functionality must be populated for the charges to be calculated.

Select from the following for further information:

Before creating the running cost charges in K2, the total cost of custodial services per building for the financial year must be known. K2 does not calculate the custodial service cost but distributes the cost per building across all occupiers based on the space they use. Charges can be entered as a lump sum for the year, a daily rate for the building or a combination of both.

To add or edit a running cost:

Search for and open the relevant building record.

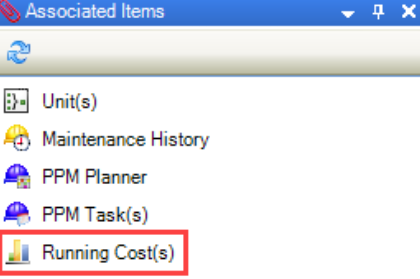

Click the Running Cost(s) option in the Associated Items panel.

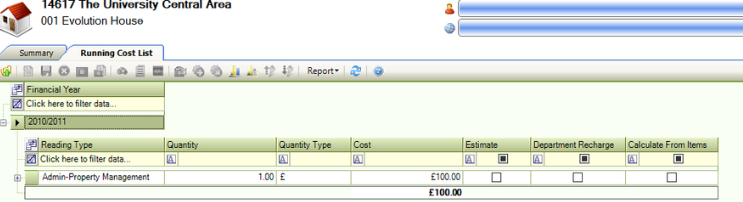

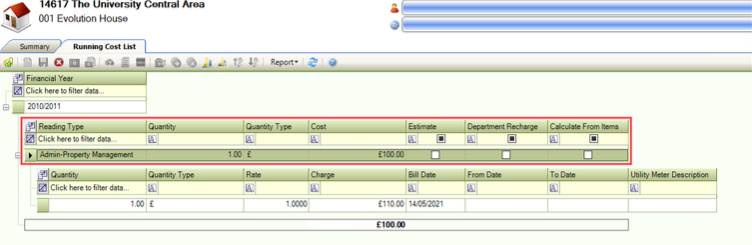

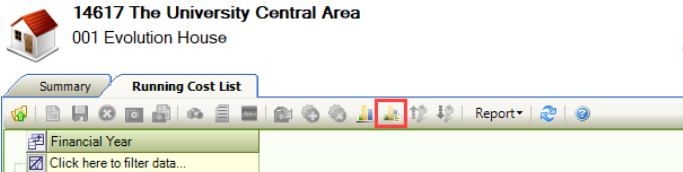

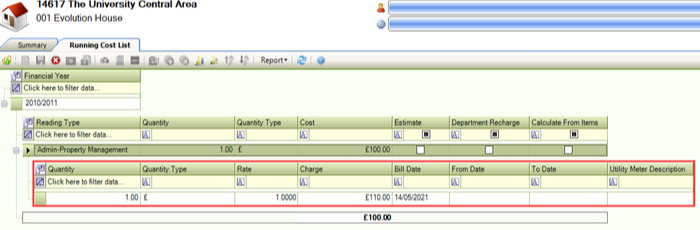

The Running Cost List screen is displayed.

Click the New Running Cost button.

Alternatively, double-click an existing running cost record to open it. Running cost records are stored in the second level of the hierarchy.

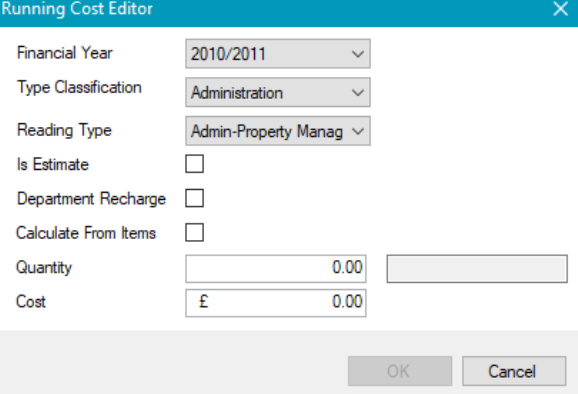

The Running Cost Editor is displayed.

Enter the relevant details.

The fields on the Running Cost Editor are described in the following table.

This field… | Holds this information... |

|---|---|

Financial Year | The financial year that the charge applies to. |

Type Classification | The type classification. These can be defined in Reading Type Classification Reference Data (accessed by navigating to Functions > Core > Reference Data > Core). |

Reading Type | The reading type. These can be defined in Reading Type Reference Data (accessed by navigating to Functions > Core > Reference Data > Core). |

Is Estimate | Whether the running cost is an estimate. This is not applicable to custodial services and must be left blank. |

Department Recharge | Whether the cost is a department re-charge. This is populated automatically based on the Reading Type Reference Data (accessed by navigating to Functions > Core > Reference Data > Core) and cannot be edited in the Running Cost Editor. |

Calculate From Items | Whether to calculate from items. This allows custodial services charges to be added midway through the financial year. This is selected by default if the Department Recharge field is selected. |

Quantity | The quantity. This is not applicable to custodial services and must be left blank. |

Cost | The cost. This is not applicable to custodial services and must be left blank. |

Click OK.

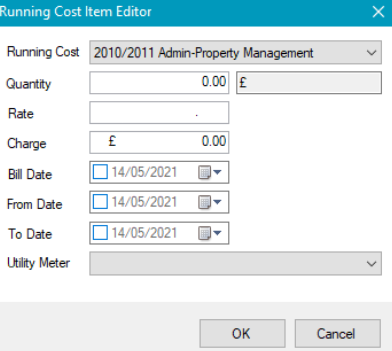

The Running Cost Item Editor window is displayed.

Enter the relevant details.

The fields on the Running Cost Item Editor are described in the following table:

This field… | Holds this information... |

|---|---|

Running Cost | The year that the charge applies to. |

Quantity | The quantity. This should be set to '1.00' as the charge should not be multiplied. |

Rate | The daily rate, if one is used to on-charge. |

Charge | The annual charge, if a lump sum is used to on-charge across the year. |

Bill Date | The bill date. This is not applicable to custodial services and must be left blank. |

From Date | The date that the charge applies from. |

To Date | The date that the charge applies to. |

Utility Meter | The utility meter. This is not applicable to custodial services and must be left blank. |

Click OK.

You can also add or edit running cost item records by doing the following:

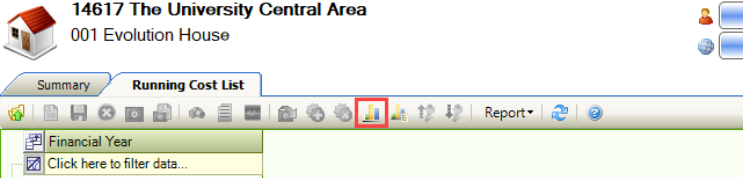

Clicking the New Running Cost Item button on the Running Cost List ribbon.

Double-clicking an existing running cost item. Running cost item records are stored in the third level of the hierarchy.

The charge calculation is based on the amount of space that a department occupies. Refer to Space On-Charging for managing department space allocations.

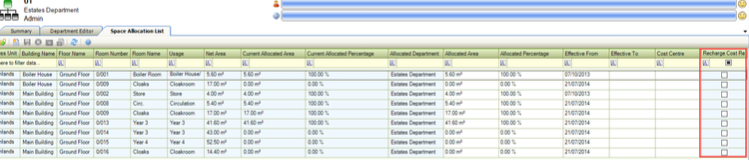

There may be scenarios where a department is charged to occupy a space that is not cleaned. It is therefore reasonable to exclude the space from the Custodial Services charge calculation (for example: a store room is considered 'Net Area' and on-charged to occupants to use, but the space is not cleaned so is excluded from the custodial services on-charge. In the department's Space Allocation List, select the Recharge Cost Required field of rooms that should be included in the custodial services charge calculation.

Midyear changes to the cost of custodial services are accommodated by adding additional running cost items. Changes can only be made to increase the cost (for example: if contractors increase their rates because the minimum wage has gone up an additional charge is added to pass the cost on to the department. The increase can be entered as either a lump sum for the remainder of the year or as a daily rate increase).

To add a midyear change, follow the instructions in Custodial Charges with the following changes to fields:

To increase the charge by a lump sum:

Charge – enter the total cost for the increase in the building

From Date – enter the date that the increase applies from

To Date – enter the date that the increase applies to

To increase the charge by a daily increase:

Rate – enter the daily rate increase

From Date – enter the date that the rate increase applies from

To Date – enter the date that the rate increase applies to

To generate space charges:

Navigate to Organisation > Department > Generate Space Usage Charges.

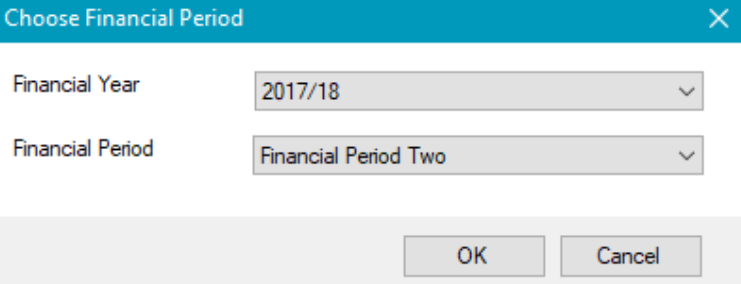

The Choose Financial Period window is displayed.

Select the relevant Financial Year and Financial Period from the drop-downs, and then click OK.

To prevent duplicate charges being created, once a charge has been generated for a period, the option can no longer be selected.

This triggers a workflow to calculate the charges for a given period in a given year.

The charge generation process creates one charge record for each space allocation assigned to the department. The charge records can be edited after they have been created provided the user has the ‘Charge’ permission.

A Custodial Services Charge record is created for each building a department has access to (for example: if a department uses rooms with the 'Re-charge' check box selected in four buildings, then four charge records are created).

To view and edit the charge record:

Search for and open the relevant department.

Click the Charge option in the Associated Items panel from the department record.

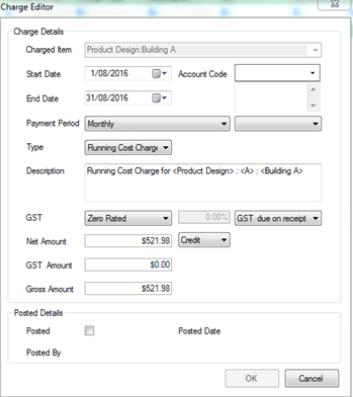

The Charge Editor is displayed. All of the details on the charge record are auto-populated when the record is created, except the 'Posted Details' section, which can be populated by an interface when the records are sent to a third-party system.

Edit the relevant details.

The fields on the Charge Editor are described in the following table:

This field… | Holds this information... |

|---|---|

Charged Item | The name of the charge in the format '<Department name>:<Building name>'. |

Start Date | The start date for the period that the charge relates to. |

End Date | The end date for the period that the charge relates to. |

Account Code | The account code. This is blank by default but can be edited. |

Payment Period | The payment period. This is set to 'Monthly' by default but can be edited. |

Type | The type of charge (that is: 'Running Cost Charge' for this charge type). |

Description | The description of the charge in the format ‘Running Cost Charge for <Department> : <Building Number> : <Building Name>’. |

GST | The Goods and Services Tax type. This is set to 'Zero Rated'. |

Net Amount | The net amount for the department per month. |

GST Amount | The Goods and Services Tax amount. This is set to '0.00' by default. |

Gross Amount | The gross amount for the department per department per month. This is set to the same as the Net Amount by default. |

Posted | Whether the charge has been posted to a third-party system. |

Posted By | The user that selected the Posted check box. |

Posted Date | The date it was posted to the third-party system. |

Click OK.